VNET Group Stock Price Prediction 2025, 2030, 2040, 2050

1. Introduction

I am beyond excited about the topic VNET Group Stock Price Prediction 2025, 2030, 2040, 2050. Investing in equities calls for a thorough study of market trends, financial performance, and future expansion possibilities. VNET Group is one stock attracting interest in the investment scene.

Leading supplier of internet data center solutions in China, VNET is vital in helping the nation to undergo a digital revolution. Those seeking long-term tech industry growth prospects sometimes question if VNET Group stock is a wise investment.

Covering fundamental elements suchas company background, financial performance, technical analysis, expert opinions, and the elements impacting its future value, this article offers a thorough VNET Group stock price projection for 2025, 2030, 2040, and 1950.

This study is to give all kinds of investors an intelligent, novice-friendly, but authoritative viewpoint on VNET stock so they may grasp it easily.

Given the chances and risks involved, we will also talk about whether it is wise to invest in VNET Group.

2. VNET Group Stock Overview

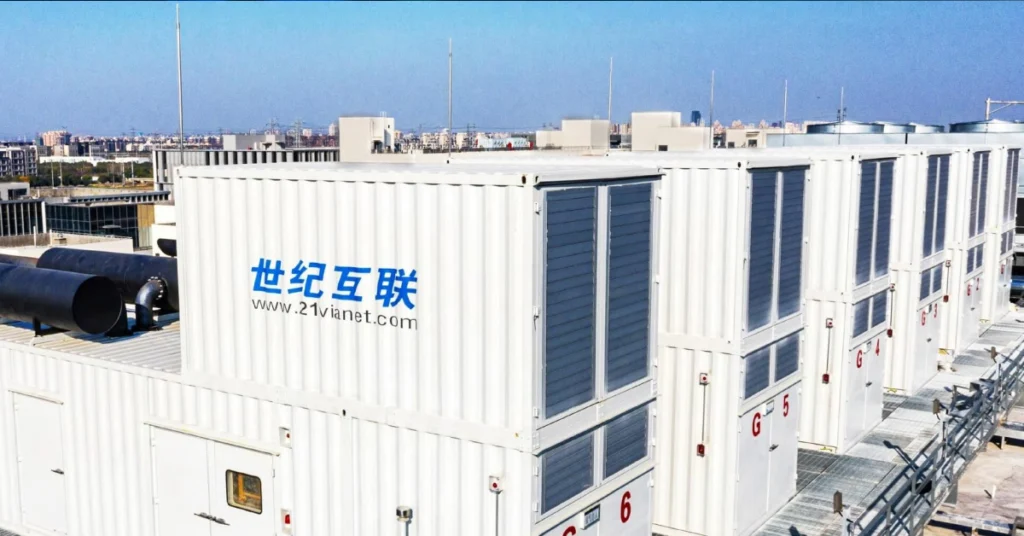

Originally called 21Vianet Group, Inc., VNET Group, Inc., a Chinese internet data center (IDC) services provider provides cloud computing, hybrid IT solutions, and hosting services.

Profiting from the fast digitalization and growing demand for cloud-based services, the company has become somewhat well-known in China.

Company Highlights

- VNN is the ticker symbol.

- Nasdaq Exchange

- Sector: Data Centre, Cloud Computing, IT Services

- headquarters: China

- Market Cap: Variations depending on market trends

- Rivals are GDS Holdings, Alibaba Cloud, Tencent Cloud, Baidu AI Cloud.

Providing data storage, cloud computing, and IT infrastructure to companies and businesses all throughout China forms VNET’s main focus in its business model.

The company is now a major participant in the market since it has enlarged its activities to satisfy the rising demand for cloud computing solutions and digital transformation tools.

3. Factors Influencing VNET Group Stock Price

Investors should take the stock price of VNET Group into account as several important elements affect it. Let’s look at these closely:

Growth of China’s Digital Infrastructure

Demand for data center services and cloud computing in China has been rising tremendously.

The necessity of safe, high-performance cloud solutions keeps growing as more companies move to digital operations.

With its large data center network, VNET Group is positioned to gain from this sector growth.

Regulatory Environment in China

The technological industry of China is run under tight government control. Any policy modification concerning foreign investment, data security, or online services can affect VNET’s operations and stock performance. Investors have to monitor government rules and policies influencing the field of cloud computing.

Financial Performance and Earnings Reports

Quarterly earnings statements and financial situation of a corporation greatly affect its stock price. Investor confidence in VNET Group is much shaped by important financial indicators such debt levels, profit margins, and income development.

Competitive Landscape

Important cloud service companies such Alibaba Cloud, Tencent Cloud, and GDS Holdings compete with VNET Group. Although VNET specializes in autonomous data center services, larger cloud giants’ competitiveness could affect its market share and profitability.

Macroeconomic Conditions

Investor attitude and stock performance can be affected by both domestic and worldwide economic situations like rates of inflation, interest rates, and geopolitical events. Financial crises or economic downturns could lower VNET stock values.

4. VNET Group Stock Price Prediction (2025, 2030, 2040, 2050)

Here is a projected range of VNET Group’s future stock price based on historical trends, technical study, and market forecasts:

| Year | Predicted Stock Price Range (USD) |

|---|---|

| 2025 | $6 – $12 |

| 2030 | $15 – $25 |

| 2040 | $35 – $50 |

| 2050 | $60 – $100 |

Note: These forecasts draw on expert opinions, historical patterns, and market analysis. Still, firm performance and unanticipated market conditions affect stock values.

5. Technical Analysis of VNET Group Stock

Analyzing past price patterns and market trends in technical analysis helps one forecast changes in stock prices. Key technical indicators for VNET stock consist in:

- The 50-day and 200-day moving averages show the stock’s phase—that of either bullish or bearish.

- Calculated as a relative strength index (RSI), this indicates if the stock is oversold or overbought.

- Finding important pricing points where the stock might turn around its trend will help you to understand support and resistance.

6. Expert Opinions on VNET Group’s Future Price

Regarding the stock performance of VNET Group, market analysts and financial analysts have different ideas.

- Optimistic View: Some analysts think VNET’s influence in China’s cloud computing development will propel long-term stock increase.

- Other experts caution that market instability, competition, and governmental policies could slow down its expansion.

- Projections of investment banks vary depending on market conditions from $8 and $20 during the following five years.

7. Should You Invest in VNET Group? (Pros & Cons)

One should consider the possible advantages and hazards of investing in VNET Group before deciding what to do.

Pros:

- robust presence in China’s expanding data centre and cloud computing sector.

- Possibility of great profits should market demand keep rising.

- Expansion in hybrid IT solutions enhances its long-term possibilities of development.

Cons:

- China’s tech industry’s regulatory ambiguities could affect company operations.

- Strong rivalry from tech behemoths like Tencent and Alibaba.

- Stock volatility is brought upon by outside events including recessionary times.

8. Conclusion for VNET Group Stock Price Prediction

VNET Group Stock Price Prediction 2025, 2030, 2040, 2050. Given China’s rising need for data centers and cloud computing, VNET Group has great expansion possibilities.

Although long-term stock price forecasts show good increases, investors have to be wary of market volatility and legislative hazards.

Making a wise investment may be achieved by means of extensive research and constant updates of financial information.

9. VNET Group Stock Price Prediction FAQs

Q: Is VNET Group a Good Investment for 2025?

A: Although VNET has promise, before making investments one should take into account hazards such rules and competition.

Q: Can VNET Stock Reach $50 by 2040?

A: Should the business maintain income growth and gain from China’s digital progress, a $50 valuation by 2040 is conceivable.

Q: What are the Risks of Investing in VNET stock?

A: The main hazards are regulatory problems, rivalry, and stock market volatility.

Q: How does VNET compare to its Competitors?

A: Though it competes with Alibaba Cloud and Tencent Cloud, VNET mostly emphasizes autonomous data center services.

Q: Where can I buy VNET Group stock?

A: NASDAQ sites including Robinhood, eToro, and TD Ameritrade let you purchase VNET shares.

This all-inclusive guide offers investors a thorough, beginner-friendly study of VNET Group’s stock price forecasts, therefore guiding their financial future.

Affiliate Disclosure - You Can Trust Us Some of the links in this article may be affiliate links, which can provide compensation to me at no cost to you if you decide to purchase a paid plan. We review these products after doing a lot of research, we check all features and recommend the best products only. To learn more about our expert unbiased reviews from your perspective, Read Our Blogs.